Table of Contents

Stock Trading vs. Investing. What’s the Difference? Stock market investing is a common technique to earn money. for people to grow their wealth over time. However, there are different approaches to investing in the stock market, and it’s essential to understand their differences.

Stock trading and investing are two different strategies people use to invest in the stock market. While both involve buying and selling stocks, their goals, strategies, time horizons, and risk tolerance differ.

This article will explore the differences between stock trading and investing and help you decide which approach is right for you.

Stock Trading vs. Investing

Stock trading is buying and selling stocks frequently, usually within a short time.

Stock trading aims to make quick profits by buying low and selling high. It requires a deep understanding of the stock market, including technical analysis, charting, and market trends.

Here are some critical characteristics of stock trading:

Short-term focus

Stock trading is focused on making quick profits, usually within a few days, weeks, or months. Traders may buy and sell the same stock multiple times daily.

Active management

Stock traders are constantly monitoring the market and making decisions based on real-time information. They need to be able to react quickly to changes in market conditions.

Use of leverage

Stock traders often use leverage, borrowing money to invest in stocks. This can increase their potential profits but also amplifies their losses.

Technical analysis

Stock traders rely heavily on technical analysis to identify trends and patterns in the market. They use charts and other tools to identify stock entry and exit points.

High risk

Stock trading is generally considered to be a high-risk strategy. The potential for significant gains also comes with the potential for large losses.

Investing

Investing, on the other hand, is a long-term strategy for growing wealth over time. Investing aims to buy stocks that will increase in value over the long run and hold onto them for years or even decades.

Investing requires a different set of skills and strategies than stock trading. Here are some critical characteristics of investing:

Long-term focus

Investing is focused on long-term gains, often for many years. Investors buy stocks with the expectation that they will increase in value over time.

Passive management

Investors typically refrain from making frequent trades or trying to time the market. Instead, they buy and hold a diversified portfolio of stocks.

No leverage

Unlike stock traders, investors do not usually use leverage to invest in the stock market. They invest their own money and do not borrow funds to invest.

Fundamental analysis

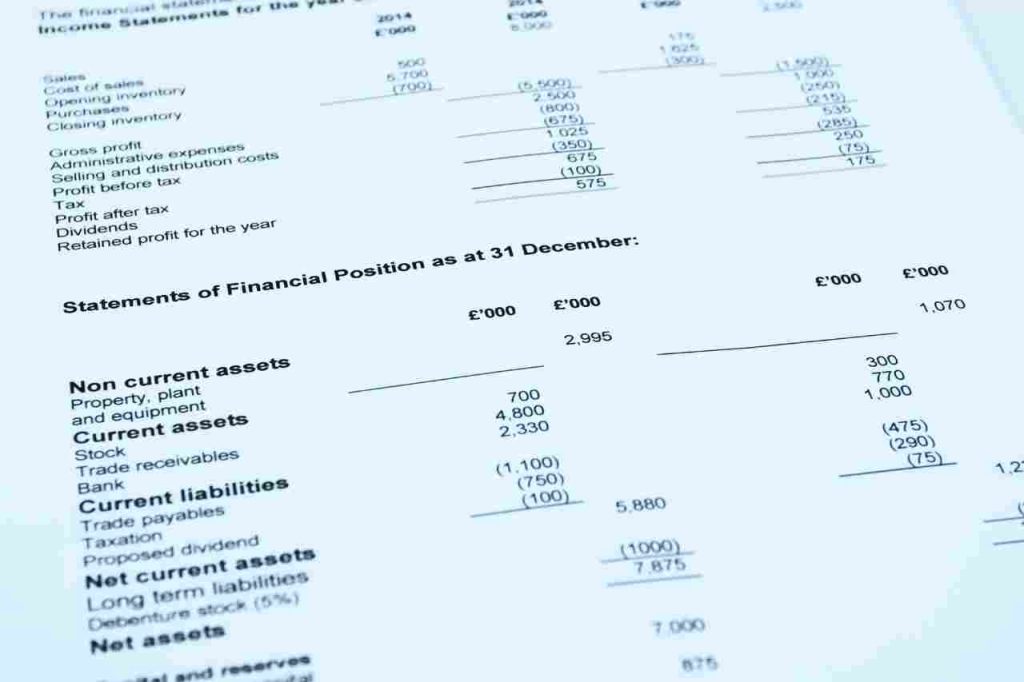

Investors rely on fundamental analysis to evaluate the value of stocks. They look at a company’s financial statements, earnings, and management team to determine whether it’s a good investment.

Lower risk

While investing still carries some risk, it’s generally considered a lower-risk strategy than stock trading.

By holding a diversified portfolio of stocks, investors can reduce their exposure to individual stock risk.

Differences between Stock Trading and Investing

There are several key differences between stock trading and investing, including:

Goals

The goals of stock trading and investing are different. The primary purpose of stock trading is to make quick profits by buying low and selling high in the short term.

Traders aim to take advantage of market volatility to generate high returns quickly.

In contrast, the primary goal of investing is to build long-term wealth through slow, steady gains.

Investors aim to buy undervalued stocks that have the potential to increase in value over the long term and then hold onto those stocks for years or even decades.

The goals of stock trading and investing reflect different investment philosophies. Stock traders are more focused on making quick profits and taking advantage of market fluctuations, while investors take a more patient approach and aim to build wealth over the long run.

It’s crucial to remember that both methods might be profitable, but they require different skills and strategies.

Stock trading can offer the potential for high returns in the short term, but it’s also riskier and requires more active management.

Investing may not offer the potential for quick profits that stock trading does, but it’s a more reliable way to build wealth over the long run, and it requires less time and effort to manage.

Strategies

Stock trading and investing require different strategies to achieve their respective goals.

Stock traders typically use technical analysis to identify short-term trends and trading opportunities in the market.

Technical analysis involves analyzing charts and using indicators to predict future price movements.

Traders also use stop-loss orders to limit their potential losses if a trade goes against them.

Trading strategies can vary widely, but common approaches include day, swing, and position trading.

On the other hand, investors typically use fundamental analysis to evaluate the long-term value of a company and its stock.

Fundamental analysis involves looking at a company’s financial statements, earnings reports, industry trends, management team, and other factors that can affect its performance over the long run.

Investors aim to identify undervalued stocks that have the potential to increase in value over time.

Once they’ve identified a good investment, they hold onto it for the long term, typically for years or even decades.

While stock traders focus on short-term trends and price movements, investors focus on the long-term growth potential of a company.

Investing requires a patient mindset and a willingness to hold onto stocks through market fluctuations and downturns.

While traders seek to profit from market volatility, investors aim to weather the ups and downs of the market and stay focused on the long-term growth potential of their investments.

Time horizons

Another critical difference between stock trading and investing is the time horizon. Stock trading is typically a short-term strategy that involves buying and selling stocks over days, weeks, or months. Traders capitalize on short-term market trends and volatility to make quick profits.

In contrast, investing is a long-term strategy that involves buying and holding stocks for years or even decades.

Investors are less concerned with short-term market fluctuations and instead focus on the long-term growth potential of their investments.

By holding stocks for the long term, investors can benefit from compounding returns and the market’s overall growth.

The time horizon for stock trading is generally much shorter than investing. By purchasing, traders hope to achieve immediate gains. And selling stocks over short periods.

This requires a high level of attention to the market and the ability to make quick decisions based on technical analysis.

On the other hand, investing is a more patient strategy that involves holding onto stocks for years or even decades.

This necessitates having a long-term vision and being prepared to weather the ups and downs of the market.

By taking a long-term approach to invest, investors can benefit from the overall growth of the market and the compounding returns that come with holding stocks over the long run.

Risk tolerance

Risk tolerance is another critical factor when comparing stock trading and investing .

Stock trading is generally considered a high-risk strategy, while investing is a lower-risk strategy.

Stock trading involves frequent buying and selling of stocks, which can result in significant losses if not done carefully.

Traders need to be able to make quick decisions based on technical analysis, and they need to be able to manage risk by using stop-loss orders and other risk management techniques.

Stock trading requires close attention to the market, which can be stressful and time-consuming.

Investing is generally considered to be a lower-risk strategy. By holding a diversified portfolio of stocks over the long run, investors can benefit from the market’s overall growth while minimizing risk.

While there is always a risk of market downturns and individual company failures, investing is generally considered a more reliable way to build wealth over the long run.

Required skills

Stock trading and investing require different sets of skills. Here are some of the critical skills necessary for each approach:

Stock trading

Technical analysis: Stock traders need to be able to analyze charts and use technical indicators to identify trading opportunities.

Risk management: Traders must manage risk using stop-loss orders and other risk management techniques.

Quick decision-making: Traders need to be able to make quick decisions based on market trends and technical analysis.

Discipline: Traders must stick to their trading plan and avoid emotional decisions.

Investing

Fundamental analysis: Investors need to be able to analyze financial statements, earnings reports, and other factors that can affect a company’s performance over the long run.

Patience: Investors must be patient and willing to hold onto stocks for years or even decades.

Long-term thinking: Investors need to be able to think about the long-term growth potential of a company and its stock rather than focusing on short-term market fluctuations.

Diversification: Investors must create a diversified portfolio of stocks to minimize risk.

Tax implications

Tax implications are essential when deciding whether to pursue stock trading or investing.

Both approaches can have different tax consequences, and it’s essential to understand how taxes will impact your returns.

Stock trading can result in short-term capital gains taxes, which are taxes on profits from stocks held for less than one year.

Taxation on short-term capital gains is equal to that of

ordinary income, which can be as high as 37% for high earners.

In addition, stock trading can result in transaction costs such as commissions and fees, which can reduce your overall returns.

On the other hand, investing can result in long-term capital gains taxes, which are taxes on profits made from stocks that are held for more than one year.

Taxes on long-term capital gains are often lower than short-term capital gains taxes, with a maximum rate of 20% for high earners.

In addition, investing can result in lower transaction costs, as stocks are held for the long term, and there is less buying and selling.

Transaction costs

Transaction costs are another important consideration when deciding between stock trading and investing.

Transaction costs are the fees and commissions associated with buying and selling stocks. These costs can significantly impact your overall returns, especially if you are engaging in frequent trading.

Stock trading typically involves frequent buying and selling of stocks, which can result in high transaction costs.

The costs associated with trading can include brokerage fees, commissions, bid-ask spreads, and other fees.

These costs can vary depending on the broker and the type of trade, but they can add up quickly, especially if you are engaging in high-frequency trading.

On the other hand, investing involves buying and holding stocks for the long term. This can result in lower transaction costs, as you are not constantly buying and selling stocks.

Time commitment

Time commitment is an important consideration when deciding between stock trading and investing.

Stock trading can require a significant time commitment, as traders must keep a close eye on market trends and news to make quick decisions about buying and selling stocks.

Day traders may need to dedicate several hours daily to monitoring the market and making trades.

On the other hand, investing typically requires less time commitment. While investors should stay informed about their portfolios and monitor market trends, they generally don’t need to make frequent trades or spend as much time tracking the market as traders do.

The time commitment required for investing can vary depending on the individual’s investment approach.

Some investors may take a more active approach to their investments, which can require more time and effort.

Income potential

Stock trading can offer higher income potential in the short term, as traders aim to generate quick profits by buying and selling stocks.

However, this approach can be riskier and lead to more significant losses if trades go differently than planned.

On the other hand, investing may offer lower income potential in the short term, as investors typically aim for steady, long-term growth. However, this approach can also be less risky and more reliable long term.

It’s important to note that income potential can vary greatly depending on individual circumstances, such as investment strategy, portfolio diversification, and market conditions.

Additionally, both stock trading and investing involve risk, and there are no guarantees of profit.

When considering income potential, it’s essential to consider the possibility of losses and have a realistic understanding of the risks involved with each approach.

Consult with a financial dvisor or research to determine which approach best suits your financial goals and risk tolerance.

Conclusion

The main difference between stock trading and investing lies in the time horizon and approach to buying and selling stocks.

Stock trading involves frequent buying and selling of stocks to generate short-term profits while investing consists of buying and holding stocks for the long term to steady long-term growth.

Choosing between stock trading and investing depends on many factors, including financial goals, risk tolerance, investment timeline, required skills, and tax implications.

It’s essential to carefully consider these factors before making any investment decisions.

Ultimately, whether you choose stock trading or investing, it’s essential to do your research and seek out the advice of financial professionals to make informed decisions about your investments. Investing and trading involve risk, and it’s essential to consider your options carefully before making any investment decisions.