Table of Contents

Stock charts are a fundamental tool for traders and investors to understand the performance of stocks in the market.

A stock chart represents a stock’s price and trading activity over a specific period. It provides crucial insights into a stock’s past performance and can help predict future trends.

Investors can identify patterns and make informed trading decisions by understanding how to read stock charts.

This article will discuss how to read stock charts and identify good patterns to help traders improve their trading strategies.

How to Read Stock Charts? Understanding Stock Charts

To effectively read and interpret stock charts, it’s essential to understand the different types of charts and their components.

Here are the basics:

Types of Stock Charts

Traders and investors use three main types of stock charts to analyze stocks: line charts, bar charts, and candlestick charts.

Also read: 10 Trading Psychology Tips to Help You Manage Emotions and Make Better Decisions

Line Charts

This is the simplest type of stock chart, which displays the closing prices of a stock over a specific period by connecting each point with a line. It shows the overall trend of a stock’s performance and helps identify support and resistance levels.

Bar Charts

A bar chart displays a stock’s open, high, low, and closing prices in a vertical bar format. The top of the bar represents the highest price, while the bottom represents the lowest price.

A horizontal line on the left and right sides of the bar, respectively, denotes the opening and closing prices.

Candlestick charts

These are similar to bar charts and show a stock’s open, high, low, and closing prices, but in a more visual way.

The body of each candlestick, which represents a single trading day, displays the starting and closing prices.

The top and bottom wicks, or shadows, on the body, stand in for the highest and lowest rates for that particular day.

Each type of stock chart has its benefits and drawbacks, and traders and investors may prefer one type over another depending on their trading style and preferences.

Understanding all three types is essential to analyze and interpret stock charts effectively.

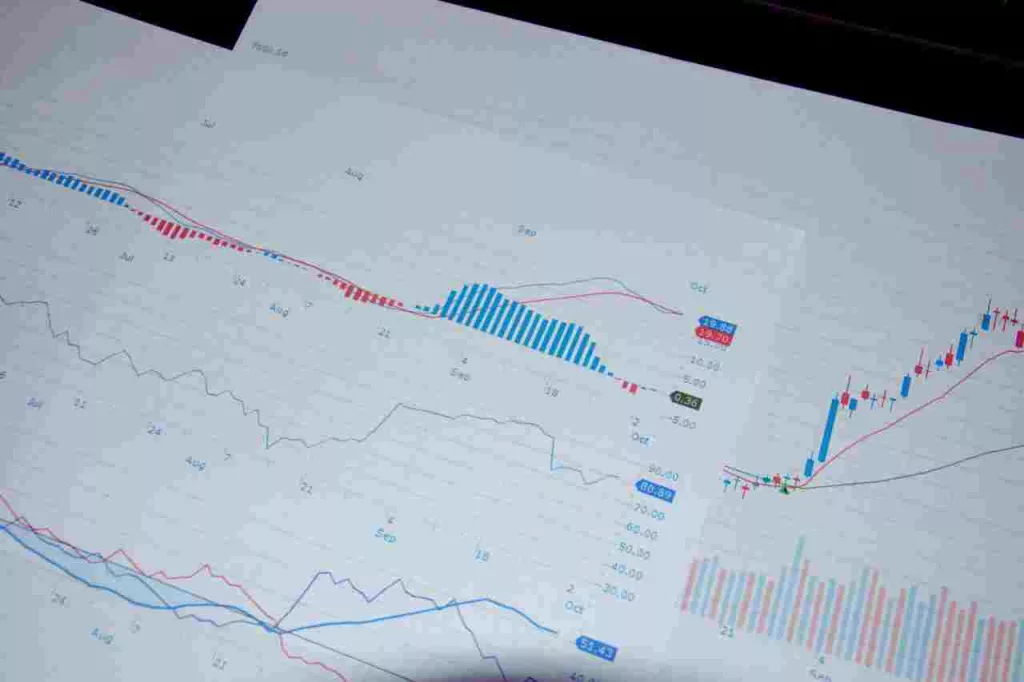

Components of a Stock Chart

To analyze a stock chart effectively, it’s essential to understand the three main components of a stock chart:

Price

The vertical axis of a stock chart shows a stock price movements over a given period.

The price axis can be represented in dollars, cents, or percentages, depending on the chart’s scaling.

Price charts provide valuable insights into a stock’s performance, including its trend, support, resistance levels, and overall trading range.

Time

The horizontal axis of a stock chart shows the timeframe of the stock price movements. Depending on the chart’s time frame, in days, weeks, months, or years, it can be compared.

The time axis helps traders and investors identify key trends and patterns in a stock’s performance.

Also read: 10 Ways to Invest That Don’t Involve the Stock Market

Volume

This is the total number of shares traded for a stock during a specific period. Volume is typically shown as a vertical bar chart or line graph below the main price chart.

The volume chart helps traders and investors understand the intensity of buying and selling pressure on a stock.

By understanding the three components of a stock chart, traders and investors can gain valuable insights into a stock’s performance and make informed trading decisions.

It’s essential to understand how these components interact with each other to gain a complete understanding of a stock’s behavior.

Reading Stock Charts

To read and analyze stock charts effectively, it’s essential to understand the following concepts:

Trends

This is the general direction in which a stocks price moves over time. There are three types of movements: uptrend, downtrend, and sideways trend.

For traders and investors to make educated judgments regarding buying and selling stocks, recognizing the kind of trend is crucial.

In an uptrend, traders and investors may look for buying opportunities or hold onto their existing positions. In contrast, in a downtrend, traders and investors may look for selling options or consider exiting their current positions.

In a sideways trend, traders and investors may look for trading opportunities within the range or wait for a breakout or breakdown from the range.

Traders and investors can use various technical analysis tools to identify trends, such as trendlines, moving averages, and chart patterns.

Trendlines are lines drawn on a stock chart to connect two or more price points and identify the direction of the trend.

Moving averages are calculated by averaging the stocks price over a given period and are used to determine the direction of the movement.

Chart patterns, such as head and shoulders and double tops, can provide insight into the stock’s trend direction.

It’s important to remember that trends can change over time, and traders and investors should use risk management strategies to minimize potential losses.

Traders and investors may choose when to purchase and sell stocks by determining the kind of trend and utilizing technical analysis tools.

Also read: Best Share Market Tips for Beginners

Support and Resistance Levels

Resistance levels are the prices at which sellers often join the market, while support levels are the prices at which buyers typically do so.

Support and resistance levels are essential technical analysis tools for traders and investors.

Support levels act as a floor for the stocks price, preventing it from falling further, while resistance levels act as a ceiling, preventing the price from rising further.

When the stocks price approaches a support or resistance level, traders and investors may look for potential buying or selling opportunities.

To identify support and resistance levels, traders and investors can use technical analysis tools such as trendlines, moving averages, and chart patterns.

When using trendlines, traders and investors draw a line connecting multiple low points to identify a support level and a line connecting multiple high points to determine a resistance level.

Moving averages can also act as support and resistance levels, with the stock price bouncing off the moving average multiple times.

Chart patterns like triangles and rectangles can also help traders and investors identify support and resistance levels.

It’s important to note that support and resistance levels are not always exact, and the stocks price may break through them.

In such cases, traders and investors may consider adjusting their trading strategy or using stop-loss orders to minimize potential losses.

Moving Averages

These are well-liked technical analysis tools that investors and traders use to determine the trend’s direction and potential support and resistance levels.

Moving averages are calculated by averaging the stock price over a specific period, and they smooth out the price fluctuations to provide a clearer picture of the stock’s trend direction.

The most often used moving averages are the 50-day and 200-day averages.

The 50-day moving average is a short-term moving average that provides insight into the stock’s short-term trend direction.

The long-term trend of a stock may be deduced from its position relative to the 200-day moving average.

Traders and investors can use moving averages in several ways. When the stock price is above the moving average, it’s generally considered a bullish signal. In contrast, when the stocks price is below the moving average, it’s generally considered a bearish signal.

Moving averages can also act as support and resistance levels, with the stock price bouncing off the moving average multiple times.

Traders and investors can also use multiple moving averages, such as short-term and long-term moving averages, to identify potential buy and sell signals.

When the short-term moving average exceeds the long-term moving average, it’s generally considered a buy signal. At the same time, when the short-term moving average crosses below the long-term moving average, it’s generally considered a sell signal.

Also read: Stock vs. ETF: Which Should You Buy?

Chart Patterns

Chart patterns are recurring patterns in a stock’s price chart that indicate a potential trend reversal or continuation. Common chart patterns include head and shoulders, double tops, and triangles.

By understanding these concepts, traders, and investors can use stock charts to identify potential buy and sell points, trends, and support and resistance levels.

It’s important to remember that no trading strategy is foolproof. Additionally, prior to making any trades, it is crucial to do one’s homework.

Identifying Profitable Patterns

Identifying profitable patterns in stock charts can be challenging, but there are a few key patterns to look out for:

Breakout Patterns

Breakout patterns occur when the price breaks through a significant level of support or resistance.

This can indicate a potential trend reversal or continuation. Traders may look for high volume when the price reaches a significant level to confirm the breakout.

Trend Continuation Patterns

During a trend, we see patterns that seem like they’ll continue the trend. Common trend continuation patterns include flags, pennants, and rectangles.

These patterns occur when the price consolidates within a narrow range before continuing in the direction of the trend.

Reversal Patterns

Reversal patterns occur when the price is likely to reverse direction. Common reversal patterns include head and shoulders, double tops, and triple bottoms.

These patterns occur when the price forms a specific shape that signals a potential reversal.

Moving Average Crossovers

Moving average crossovers occur when two moving averages cross over each other. Traders may use the 50-day and 200-day moving averages to identify a potential trend reversal or continuation.

When the 50-day moving average exceeds the 200-day moving average, it’s known as a “golden cross,” which may signal a bullish trend. When the 50-day moving average exceeds the 200-day moving average, it’s known as a “death cross,” which may signal a bearish trend.

It’s important to remember that patterns do not guarantee a stock’s future performance; trade choices should only be made after extensive study and investigation.

Traders should also use risk management strategies, such as stop-loss orders, to minimize potential losses.

Also read: The Role of Technical Analysis in Stock Market Trading: A Comprehensive Guide

Tips for Successful Analysis

Here are some suggestions for the successful analysis of stock charts:

Identify the appropriate time frame

Selecting the appropriate time frame based on your trading strategy is essential. A daily or hourly chart suits short-term traders, while long-term investors prefer a weekly or monthly chart.

Use multiple time frames.

Multiple time frames can provide a more comprehensive view of a stock’s behavior.

Traders can use longer-term time frames to identify the overall trend, while shorter-term time frames can be used to identify entry and exit points.

Pay attention to volume.

Volume is a crucial indicator that can help confirm price movements. A significant increase in volume can signal a potential trend reversal or continuation.

Look for confirmation from other indicators.

Using multiple indicators, such as moving averages and relative strength index (RSI), can confirm a potential trend reversal or continuation.

Also read: Best Brokerage Trading Platforms

Develop a trading plan.

A trading plan including entry and exit points, stop-loss orders, and profit targets can help traders stay disciplined and minimize potential losses.

Keep up with news and events.

Keeping up with news and events impacting a stock’s performance can help traders make informed decisions.

It’s necessary to conduct thorough research and analysis before making any trading decisions.

Practice To Make it Perfect

Practice is key to becoming proficient in analyzing stock charts. Here are some ways to practice:

Use a demo trading account

Many brokers offer demo trading accounts that allow traders to practice trading without risking real money.

This is a great way to practice analyzing stock charts and testing different trading strategies.

Backtesting

Backtesting involves using historical data to test a trading strategy. Traders can use software to simulate trades and analyze how the strategy would have performed in the past.

Also read: Which stock market is good to invest in?

Analyze historical charts

Trading choices in the future might be influenced by patterns and trends that are discovered by analyzing past charts.

Traders can analyze charts for stocks they are interested in trading or stocks they have previously traded.

Join a trading community.

Joining a trading community can provide valuable insights and perspectives from other traders. Traders can discuss strategies, share insights, and ask for feedback on their analysis.

Attend webinars and seminars.

Attending webinars and seminars hosted by trading experts can provide valuable insights and strategies for analyzing stock charts.

By practicing regularly, traders can improve their skills in analyzing stock charts and making more informed trading decisions.

It’s important to remember that trading involves risk, and traders should use risk management strategies to minimize potential losses.

Conclusion

For traders and investors to make wise judgments regarding buying and selling stocks, stock chart analysis is essential.

Understanding the components of a stock chart, types of charts, and key patterns can help traders identify profitable opportunities.

However, it’s necessary to remember that no trading strategy is foolproof, and traders should use risk management strategies to minimize potential losses.

Also read: The Psychology of Investing: Overcoming Emotions and Making Rational Decisions

By using multiple time frames, paying attention to volume, and confirming trends with other indicators, traders can conduct a successful analysis of stock charts.

Practicing regularly and staying up-to-date on news and events that impact a stock’s performance can also help traders make informed decisions. With practice and discipline, traders can improve their skills in analyzing stock charts and increase their chances of success in the stock market.