Table of Contents

In the world of investing, there’s a famous saying: “Timing the market is less crucial than spending time in the market.” This timeless wisdom encapsulates the essence of long-term investing, emphasizing the value of consistency and patience.

Dollar-cost averaging (DCA) is a strategy that embodies this philosophy, offering investors a powerful tool to navigate the volatility of financial markets while steadily building wealth over time.

We will explore the benefits of investment averaging through the dollar-cost averaging (DCA) strategy and why it’s an essential strategy for anyone looking to secure their financial future through long-term investing.

What is Dollar-Cost Averaging?

Dollar-cost averaging (DCA) is an investment strategy designed to help investors navigate the often unpredictable and volatile nature of financial markets. It involves the consistent and systematic purchase of a particular asset, such as stocks, bonds, or mutual funds, at regular intervals, typically on a predetermined schedule.

What sets DCA apart from attempting to time the market is that it doesn’t rely on trying to predict the optimal moments to buy or sell assets. Instead, investors commit to investing a fixed amount of money at specified intervals, regardless of the asset’s current market price.

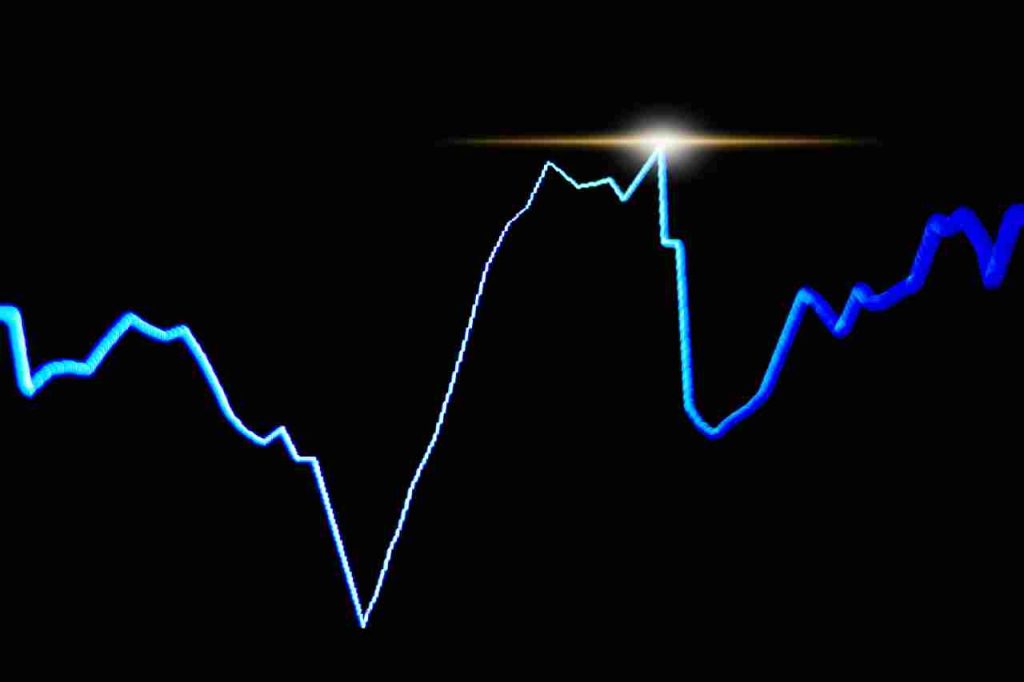

The primary advantage of DCA lies in its ability to lower the impact of market fluctuations and emotional decision-making on an investor’s portfolio. By purchasing assets at various price points over time, DCA essentially spreads the investment risk.

When prices are high, the fixed investment amount buys fewer shares, and when prices are low, it buys more shares.

Over the long term, this averaging effect helps smooth out the overall cost basis of the investment, potentially resulting in a lower average purchase price and reducing the risk of significant losses due to poor timing.

Dollar-cost averaging is especially favored by long-term investors as it promotes financial discipline, encourages consistent savings habits, and ultimately supports wealth accumulation through a patient and systematic approach to investing.

How Does Dollar-Cost Averaging Work?

Dollar-cost averaging (DCA) is a straightforward investment strategy that operates on a simple principle: consistently investing a fixed amount of money at predetermined intervals, irrespective of the asset’s current price at the time of purchase.

Here’s how DCA works step by step:

Set a Regular Investment Interval

First, you establish a schedule for making investments. This can be monthly, quarterly, or any other interval that suits your financial situation and goals. For example, you might decide to invest $500 every month.

Allocate Funds

Determine the amount of money you want to allocate to your investment portfolio during each interval. This is the fixed amount you will invest without fail. Using the earlier example, you’ll invest $500 every month.

Select the Asset

Pick the asset or assets you want to invest in. It could be individual stocks, mutual funds, exchange-traded funds (ETFs), or any other investment vehicle. Your choice of asset should align with your long-term financial goals and risk tolerance.

Execute Regular Purchases

At each scheduled interval, you invest the fixed amount of money you’ve allocated, purchasing the chosen asset. Regardless of whether the asset’s price has gone up or down, you stick to your predetermined investment plan.

Accumulate Shares Over Time

Over the course of months or years, you’ll accumulate shares of the asset at various price points. When prices are higher, your fixed investment amount buys fewer shares, and when prices are lower, it buys more shares. This averaging effect helps reduce the impact of market volatility.

Track Progress

Periodically review your investment portfolio to monitor your progress toward your financial goals. If necessary, alter your DCA approach, but avoid taking hasty action in response to momentary market fluctuations.

By adhering to a DCA strategy, you effectively remove the stress and guesswork associated with trying to time the market. Instead, you focus on consistent, disciplined investing that can help you build wealth steadily over the long term, regardless of the market’s ups and downs.

Here’s a simplified example to illustrate how DCA works:

Say you had $10,000 to put toward a specific investment. You choose to employ a DCA technique rather than investing the entire sum at once.

You invest $1,000 every month for ten months.

Regardless of whether the stock’s price is high or low during each month, you invest the fixed $1,000.

Over time, you accumulate shares of the stock at various price points.

By the end of the ten months, you’ll have invested the entire $10,000, but you’ll own shares of the stock at different prices, creating an average cost per share. This averaging process reduces the impact of market fluctuations and minimizes the risk associated with making large lump-sum investments at potentially unfavorable times.

The Benefits of Dollar-Cost Averaging and Investment Averaging

Dollar-cost averaging (DCA) offers several compelling benefits for investors, making it a popular strategy for those looking to build wealth over the long term. Here are the key advantages of using DCA:

Risk Mitigation

DCA is designed to reduce the impact of market volatility and uncertainty. By consistently investing a fixed amount at regular intervals, you spread your investments across different market conditions.

This means that when prices are high, your fixed investment buys fewer shares, and when prices are low, it buys more shares.

This averaging effect reduces the risk associated with trying to time the market over time, as you’re less exposed to the potential downsides of making large lump-sum investments at unfavorable moments.

Emotion Control

Emotion control is a critical aspect of successful investing, and dollar-cost averaging (DCA) serves as a powerful tool for achieving it. Emotions like fear and greed often drive investors to make impulsive decisions, such as panic-selling during market downturns or greed-driven overinvestment during bull markets.

These emotional reactions can lead to poor investment choices and significant financial losses. DCA addresses this by removing the need for emotional reactions to market fluctuations. When you employ a DCA strategy, you commit to a predetermined investment plan, regardless of whether the market is in a bullish (upward) or bearish (downward) phase.

By sticking to your plan in a disciplined manner, DCA helps reduce the likelihood of making hasty, fear-based decisions when the market becomes turbulent. Your ability to retain a long-term perspective and concentrate on your financial objectives rather than responding to short-term market noise is enabled by this methodical strategy.

It provides a sense of control and rationality, allowing you to stay on course even when external factors might trigger emotional responses. In essence, DCA empowers investors to resist the emotional rollercoaster of the market, leading to more consistent and rational decision-making that aligns with their long-term financial objectives.

Consistency

Consistency is a cornerstone of financial success, and dollar-cost averaging (DCA) plays a pivotal role in fostering this crucial quality. DCA enforces a structured and regular savings and investing habit. This means that, on a set schedule, you commit to investing a fixed amount of money, whether it’s weekly, monthly, or at another regular interval.

The consistency of this approach is vital because it ensures that you’re continually putting money to work for you in the market.

This regular and disciplined investment regimen promoted by DCA instills financial discipline in individuals. It encourages them to stay committed to their long-term financial goals, whether that goal is building a retirement nest egg, saving for a major life event, or simply growing their wealth over time.

By adhering to a predetermined investment plan and consistently allocating funds to their chosen assets, individuals can develop a strong sense of financial responsibility and diligence. Over time, the cumulative effect of this consistency can lead to substantial wealth accumulation, all while reinforcing disciplined financial behaviors that contribute to financial well-being.

Lower Entry Barriers

DCA makes investing accessible to a broader range of people. You don’t need a large lump sum of money to get started.

By making a set amount of frequent investments, even those with limited initial capital can begin building their investment portfolios gradually.

Potential for Compounding

One of the most powerful aspects of DCA is its potential to harness the benefits of compounding returns. As your investments grow over time, the returns generated on your previous investments can reinvested alongside your regular contributions.

Over time, this compounding impact can greatly increase your overall profits and hasten the expansion of your portfolio.

Reduced Timing Risk

Attempting to time the market by making large lump-sum investments can be a risky endeavor. DCA eliminates the need to predict market highs and lows, reducing timing risk. Investors avoid the potential disappointment of investing a significant amount just before a market downturn.

Flexibility

DCA can be adapted to suit your financial situation and goals. You can easily adjust the amount you invest or the frequency of your investments as your circumstances change. This flexibility makes it a versatile strategy that can be tailored to your needs.

Automatic Investing

DCA often involves setting up automatic contributions to your investment account. This automation simplifies the investing process and ensures that you consistently allocate funds to your investments, even when life gets busy.

Steady Accumulation

Over time, DCA leads to a steady accumulation of assets. This can be particularly beneficial for goals like retirement planning, where you aim to build a substantial nest egg gradually. With DCA, you’re less reliant on market timing and more reliant on the steady commitment to your investment plan.

Peace of Mind

The simplicity and reliability of DCA can provide investors with peace of mind. Knowing that you have a structured and proven approach to investing can reduce financial stress and anxiety, as you don’t have to constantly monitor and react to market fluctuations.

Behavioral Benefits

DCA can positively influence investor behavior. It discourages market timing and discourages frequent trading, which, in terms of fees and taxes, can be expensive. Instead, it encourages a long-term perspective and patience, aligning your actions with your financial goals.

Diversification

Over time, DCA can lead to a diversified portfolio as you accumulate assets in various market conditions. Diversification can help spread risk further and potentially enhance long-term returns.

Why Dollar-Cost Averaging is Ideal for Long-Term Investing

Dollar-cost averaging is particularly well-suited for long-term investors for several reasons:

Mitigating Timing Risk

One of the primary challenges for long-term investors is the uncertainty of market timing. Attempting to enter the market at the absolute lowest point or exit at the highest point is exceedingly difficult, even for seasoned professionals.

DCA removes the pressure to make these precise timing decisions. Instead, it ensures you invest consistently over time, spreading the risk associated with market volatility.

Consistency and Discipline

Successful long-term investing requires discipline and consistency. DCA enforces these qualities by setting a regular investment schedule.

This consistency ensures that you stay committed to your financial goals even when market conditions become turbulent or emotions run high. It helps investors avoid making impulsive decisions during market downturns.

Compounding Returns

Long-term investors often have the advantage of time on their side. DCA leverages this advantage by consistently putting money to work in the market. As your investments grow, the returns generated on your previous investments can be reinvested alongside your regular contributions.

This compounding effect can significantly boost the growth of your portfolio over time, particularly when you hold investments for many years.

Risk Reduction

DCA inherently reduces the risk associated with investing large sums of money at a single point in time. DCA spreads your investments throughout multiple market situations rather than investing a sizable sum of money in the market all at once, which might be problematic if the market undergoes a fall shortly after.

This strategy minimizes the impact of unfavorable timing and market fluctuations.

Psychological Comfort

Long-term investing can be an emotional rollercoaster, especially during periods of market volatility.

DCA provides psychological comfort by removing the need for constant market monitoring and decision-making. Investors can confidently stick to their predetermined investment plan, knowing they are following a proven strategy.

Accessibility

DCA is accessible to a wide range of investors, regardless of their initial capital. You can start with a relatively small amount and gradually increase your investment contributions over time as your financial situation improves. This accessibility makes it inclusive and achievable for individuals with varying income levels.

Simplified Investment Approach

Long-term investing can become overwhelming if you’re constantly chasing market trends or reacting to short-term fluctuations.

DCA simplifies the investment process by encouraging a set-it-and-forget-it mentality. This enables investors to put their attention on their overall financial goals rather than the day-to-day changes in the market.

Conclusion

Dollar-cost averaging is a powerful strategy for long-term investors looking to build wealth steadily and securely. By consistently investing over time, regardless of market conditions, investors can reduce risk, harness the potential of compounding returns, and achieve their financial goals with discipline and patience.

Remember, it’s not about timing the market; it’s about time in the market. So, embrace the power of dollar-cost averaging and embark on your journey to financial success.