Table of Contents

Reading financial statements is crucial if you want to be successful in investing. Financial statements are a crucial source of information that can help you assess the financial health of a company, its growth potential, and its overall value. The stock market may be a terrific method to gradually increase your money, but it can also be a hazardous business.

Examining the company’s financial statements is among the most crucial things a buyer of shares can do.

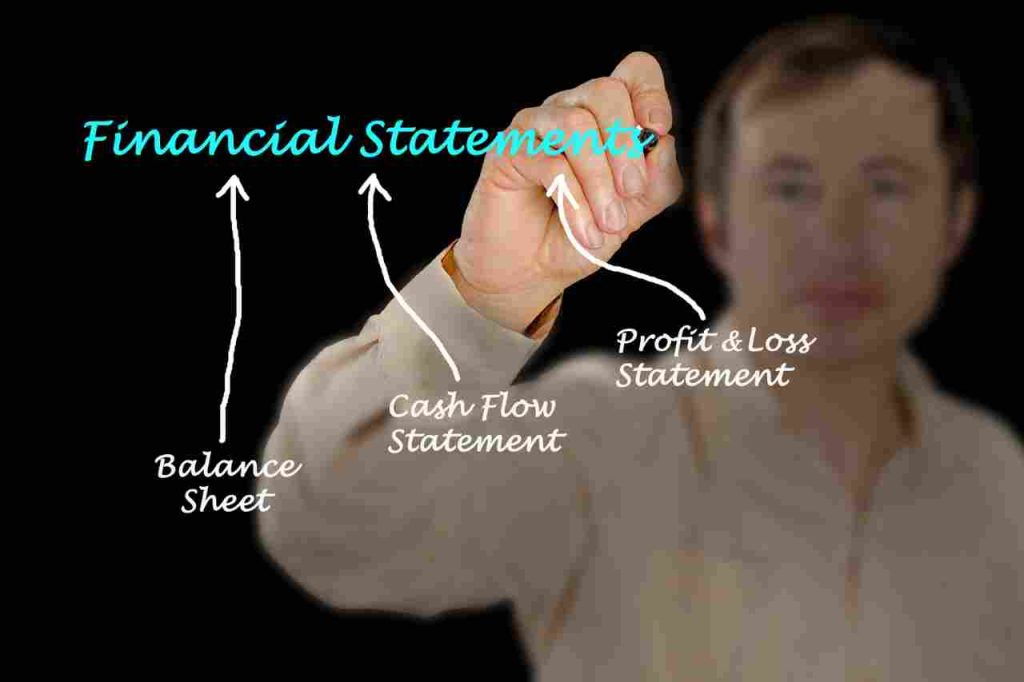

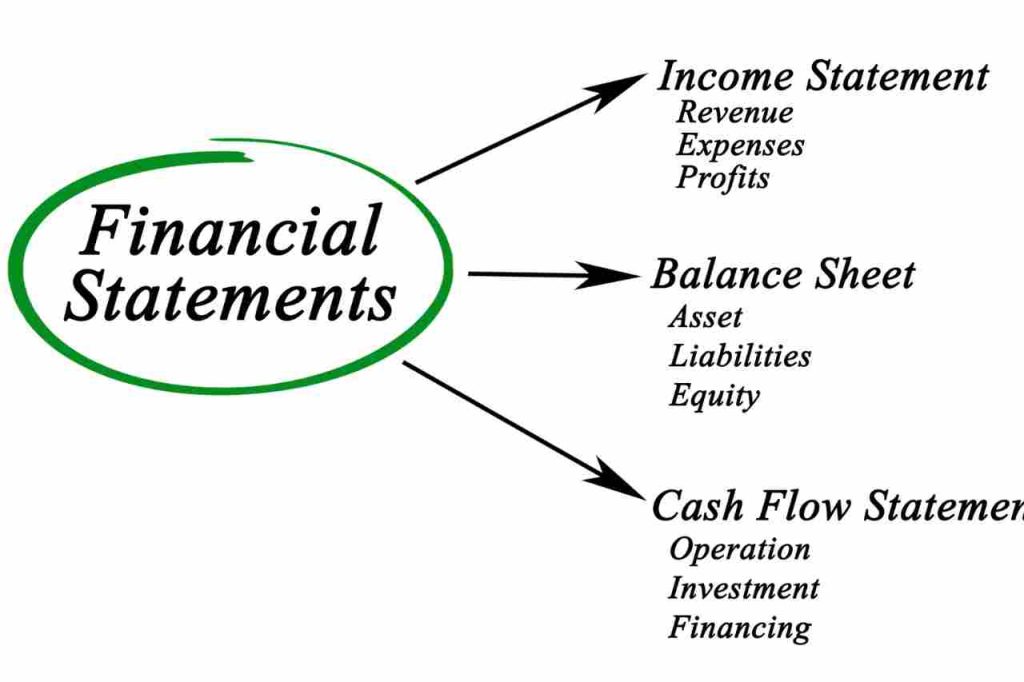

The three main financial statements—the balance sheet, income statement, and cash flow statement—as well as the significance of reading financial statements before investing will all be covered in this blog article.

The three main financial statements—the balance sheet, income statement, and cash flow statement—will be briefly discussed in this blog article, along with the significance of reading financial statements before investing, what they are, and why they matter.

We will also explore how to analyze these statements, what key components to look for, and what common red flags to watch out for when reviewing financial statements.

Lastly, we will discuss how to use ratio analysis to interpret the information in financial statements and make informed investment decisions.

Reading financial statements. Account statement

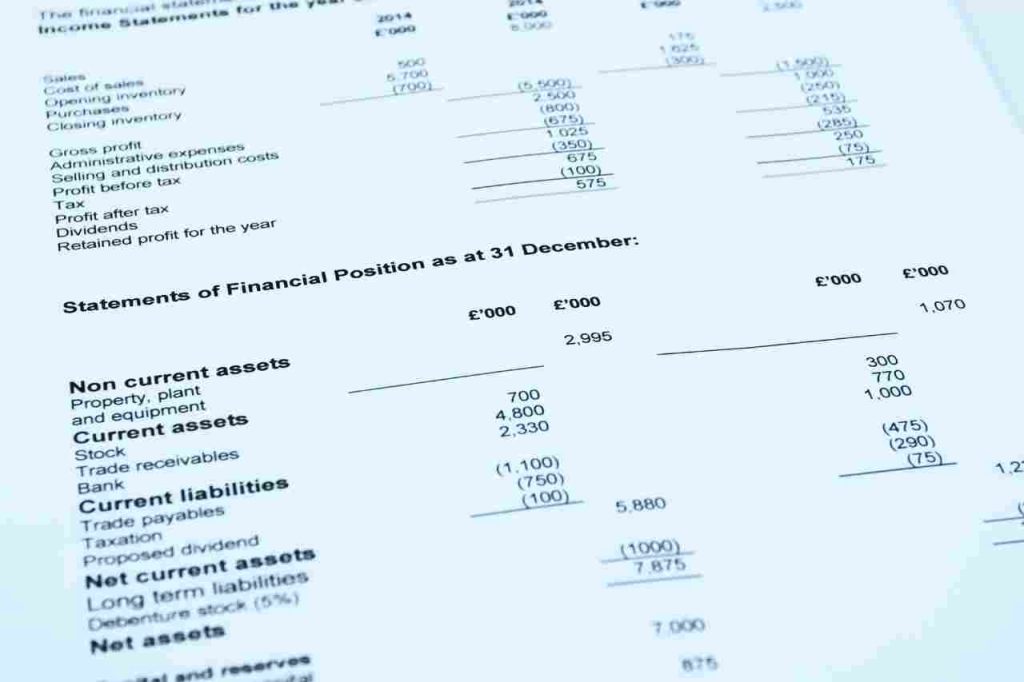

One of the three crucial financial statements that investors should examine before making an investment in a company is the balance sheet.

A balance sheet gives an overview of a company’s financial situation at a particular period. The assets, liabilities, and equity of the business are displayed.

Assets are things the company owns that have value, such as cash, inventory, and property.

Liabilities are the company’s obligations to others, such as loans, accounts payable, and taxes owed. Equity represents the residual value of the company, which is what’s left over after liabilities are subtracted from assets.

A balance sheet analysis can provide information about a company’s financial situation and capacity to pay its debts. When examining the balance sheet, some important things to keep an eye out for are

Liquidity: Check the company’s current ratio (current assets divided by current liabilities). A percentage of 1 or higher indicates that the company has enough existing assets to cover its current liabilities.

Debt-to-equity ratio: This ratio compares a company’s debt to its equity. A high debt-to-equity ratio may indicate that the company relies heavily on debt to finance its operations, which can increase risk.

Asset turnover ratio: This ratio shows how efficiently a company uses its assets to generate revenue. A higher percentage is generally better as it indicates the company generates more revenue per dollar of assets.

The balance sheet can provide valuable insights into a company’s financial health and help investors decide whether to invest in a particular company.

Income Statement

The income statement is another important financial statement that investors should review before investing in a company.

The income statement shows a company’s revenues, expenses, and net income over a specific period, such as a quarter or year.

The income statement provides insights into a company’s profitability and its ability to generate revenue.

Key components of the income statement include:

Revenues: This is the money the company has earned from sales of products or services.

Cost of goods sold: This is the direct cost of producing the goods or services sold by the company.

Gross profit: This is the difference between revenues and the cost of goods sold.

Operating expenses: These are the costs of running the business, such as salaries, rent, and utilities.

Operating income: This is the difference between gross profit and operating expenses.

Net income: The company’s total earnings after all expenses have been deducted.

Analyzing the income statement can help investors evaluate a company’s profitability and its ability to generate revenue.

When examining the income statement, it’s important to keep an eye out for things like:

Revenue trends: Look for trends in revenue growth over time. Steady or increasing revenues may indicate a healthy business.

Profit margins: Analyze the company’s gross and net profit margins. A company with higher profit margins may be more profitable and have a more extraordinary ability to reinvest in the business.

Operating expenses: Look for trends in operating expenses. If payments are consistently increasing, it may indicate that the company is having trouble controlling costs.

The income statement provides a valuable snapshot of a company’s financial health and can help investors decide whether to invest in a particular company.

Cash Flow Statement

The cash flow statement is the third critical financial statement that investors should review before investing in a company.

The cash flow statement shows the inflows and outflows of cash during a specific period, such as a quarter or year.

The statement is divided into three main sections: operating activities, investing activities, and financing activities.

Operating activities: This section shows the cash flows from the company’s primary operations, such as sales and inventory purchasing.

Investing activities: This section shows the cash flows from the company’s investing activities, such as purchasing or selling of long-term assets.

Financing activities: This section shows the cash flows from the company’s financing activities, such as issuing or repurchasing stock and taking out or repaying loans.

Analyzing the cash flow statement can help investors evaluate a company’s ability to generate cash and its financial flexibility.

When examining the cash flow statement, it’s important to keep the following in mind:

Cash flow trends: Look for trends in operating cash flows over time. Steady or increasing cash flows may indicate a healthy business.

The cash flow that remains after a corporation has paid for its capital expenditures is known as free cash flow. A healthy free cash flow shows that the business has money to invest or return to shareholders.

Debt repayment: Analyze the company’s cash flows from financing activities to see if the company is taking on or repaying debt. If a company takes on a lot of debt, it may indicate financial risk.

The cash flow statement provides a valuable view of a company’s ability to generate cash and manage its financial resources.

Analyzing the statement can help investors decide whether to invest in a particular company.

Ratio Analysis

Ratio analysis is an influential tool investors use to analyze a company’s financial statements and evaluate its financial health.

Ratios help investors understand the relationships between different financial statement items and identify potential risks or opportunities.

Here are some key ratios that investors may use in their analysis:

Price-to-earnings (P/E) ratio

The price-to-earnings (P/E) ratio is a widely used ratio in financial analysis. It measures the price of a company’s stock relative to its earnings per share (EPS).

Essentially, the P/E ratio tells investors how much they will pay for each dollar of earnings the company generates.

A higher P/E ratio might mean that investors have high hopes for the company’s potential for future profits growth, which is good news for the company’s prospects.

On the other hand, a lower P/E ratio may indicate that investors have lower expectations for the company’s future earnings growth potential, which may be a negative sign for the company’s future prospects.

Debt-to-equity ratio

A financial ratio called the debt-to-equity ratio compares a company’s total debt to its total equity. It sheds light on how much borrowing a business is doing to finance its operations.

A high debt-to-equity ratio may show that the business substantially relies on debt financing, which raises risk. A corporation may have trouble paying its debt commitments if it has a high debt-to-equity ratio, which might result in bankruptcy or other financial issues.

On the other side, a low debt-to-equity ratio can mean that the business is relying more on equity to fund its operations, which might be less hazardous but might restrict its ability to expand.

On the other hand, a low debt-to-equity ratio may indicate that the company is financing its operations more with equity, which can be less risky but may limit the company’s growth potential.

Return on equity (ROE)

On the other side, a low debt-to-equity ratio can mean that the business is relying more on equity to fund its operations, which might be less hazardous but might restrict its ability to expand.

A higher ROE indicates the company generates more profit per dollar of equity. This can be a positive sign for investors, suggesting that the company uses its resources effectively to generate profits. It also indicates the company is developing a high return for its investors’ capital.

Present ratio

A financial ratio called the current ratio contrasts a company’s current obligations with its current assets. It utilizes existing assets to assess a company’s capacity to fulfill its immediate obligations.

A ratio of 1 or higher indicates that the company has enough current assets to cover its current liabilities. This means that the company is likely to be able to pay off its short-term debts and meet its obligations as they come due.

On the other hand, a current ratio of less than one may indicate that the company may have difficulty meeting its short-term obligations, which can be a red flag for investors.

A low current ratio may suggest that the company is facing financial difficulties and may be at risk of defaulting on its debts.

A financial ratio called the current ratio contrasts a company’s current obligations with its current assets. It utilizes existing assets to assess a company’s capacity to fulfill its immediate obligations.

The corporation has adequate current assets to meet its current obligations if the ratio is 1 or greater. This indicates that the business will probably be able to pay off its current liabilities and fulfill its commitments when they become due..

On the other hand, a current ratio of less than one may indicate that the company may have difficulty meeting its short-term obligations, which can be a red flag for investors.

A low current ratio may suggest that the company is facing financial difficulties and may be at risk of defaulting on its debts.

Return on investment (ROI)

This ratio demonstrates the amount of profit an organization makes in relation to the capital invested in the company. A greater ROI means that the business makes more money for every dollar invested.

Ratio analysis can provide valuable insights into a company’s financial health and help investors decide whether to invest in a particular company.

Common Red Flags

Investors should be aware of certain red flags that may indicate potential problems with a company’s financial health.

Here are some typical warning signs to watch out for:

Negative earnings: A company that consistently reports negative earnings may not generate enough revenue to cover its expenses. This can indicate poor financial health and suggest the company struggles to compete in its industry.

High debt levels: A company with high debt levels may have difficulty making its debt payments, which can lead to financial distress or even bankruptcy. Investors should be wary of companies with high debt levels, especially if they cannot generate enough revenue to cover their debt obligations.

Inconsistent earnings: A company with erratic earnings may be unpredictable and may have difficulty maintaining profitability over the long termInvestors want to seek out businesses with a proven track record of steady earnings development and a sound company strategy.

Poor cash flow: A company with poor cash flow may have difficulty paying its bills or funding its operations. This can signify poor financial management or a weak business model.

Accounting irregularities: Companies that engage in accounting irregularities or financial fraud may mislead investors about their financial health. Investors should be wary of companies that have a history of accounting irregularities or that fail to disclose important financial information.

Declining revenue

A company with declining revenue may have trouble sustaining its operations and may be losing market share to competitors.

High debt levels

High debt levels may put a business at danger of loan default, which might result in bankruptcy.

Negative cash flow

A company with negative cash flow may have trouble paying its bills or investing in future growth.

Irregular or inconsistent earnings

Companies with inconsistent earnings may have trouble sustaining profitability, and their stock prices may be volatile.

Unusual accounting practices

Companies that use unusual accounting practices or frequently restate their financial statements may be trying to hide financial problems.

Insider selling

If company insiders are selling their shares, it may indicate that they believe the stock is overvalued or that they are not optimistic about the company’s future prospects.

Legal or regulatory problems

Companies facing legal or regulatory problems, such as lawsuits or investigations, may face financial penalties or damage to their reputation.

It’s important to note that a single red flag does not necessarily mean that a company is in trouble. Investors should consider multiple factors when analyzing a company’s financial health and should always do their due diligence before making investment decisions.

Conclusion

Ratio analysis and an understanding of financial statements may give investors important information about a company’s financial health and assist them in making well-informed investment decisions.

When reviewing financial statements, investors should look for trends, anomalies, and red flags indicating potential risks or opportunities.

While financial analysis can be a powerful tool, it’s essential to consider the broader economic and market conditions and to always do thorough due diligence before making investment decisions. By being diligent and informed, investors can increase their chances of making successful investments and achieving their financial goals.