Table of Contents

Investment in the stock market may be lucrative, but it’s not without its fair share of risks. Market volatility is an inherent aspect of the financial world, and as an investor, it’s crucial to have a plan in place to protect your portfolio during turbulent times.

The use of hedging tactics is one of the best approaches to reduce risk. In this blog post, we’ll delve into the concept of hedging, explore various hedging strategies, and discuss their importance in safeguarding your investments in volatile markets, all while emphasizing the significance of risk management in investing.

Understanding Hedging

Hedging is a fundamental concept in the world of finance and investing, and its importance cannot be overstated. At its core, hedging is a financial strategy that involves taking deliberate actions to mitigate or offset the potential losses associated with an investment. In essence, it’s a form of insurance for your portfolio.

Just as you might purchase insurance to protect your home or car from unforeseen events, hedging aims to protect your financial assets from the unpredictable fluctuations of the market.

Imagine you have a substantial investment in a particular stock, and you’re concerned that its price may decline due to factors such as economic downturns, industry-specific issues, or geopolitical events.

To safeguard your portfolio from the negative impact of such adverse market movements, you might employ a hedging strategy. This strategy involves taking a position that will profit if the stock price falls, effectively counterbalancing any losses incurred in your stock holdings. In simpler terms, it’s like having a safety net to catch you if you fall.

The Importance of Hedging in Portfolio Protection and Risk Management

In today’s financial landscape, where market volatility can be influenced by various factors, including economic events, geopolitical tensions, and even global health crises, having a robust hedging strategy is paramount for portfolio protection and effective risk management in investing.

Here are some reasons why hedging is crucial:

Preservation of Capital

Preservation of capital is a fundamental principle in investing, and hedging plays a crucial role in achieving this goal. When you invest your hard-earned money in the financial markets, you inherently expose it to various risks, including the possibility of market downturns. These downturns can erode the value of your investments and, in severe cases, lead to substantial losses.

This is where hedging steps in as a protective mechanism. By employing hedging strategies, investors aim to minimize the impact of these market downturns on their capital. In essence, hedging provides a safety net that shields your portfolio from significant losses, thereby preserving your initial investment.

This protection is particularly vital for individuals who rely on their investments to meet long-term financial goals, such as retirement. Market volatility and downturns can have a devastating effect on retirement savings, potentially forcing retirees to either delay their retirement plans or compromise their lifestyle during retirement. Hedging strategies help mitigate these risks, offering a sense of security and financial stability.

Whether you’re nearing retirement age or simply looking to safeguard your capital for future financial objectives, the preservation of capital through hedging is a prudent and responsible approach to investment management.

Reduced Emotional Stress

Investing in volatile markets can be emotionally taxing, and one of the lesser-discussed benefits of hedging is its capacity to reduce emotional stress for investors. When financial markets are characterized by rapid fluctuations and uncertainty, it’s not uncommon for emotions like fear, anxiety, and panic to take center stage.

These emotions can lead to impulsive decision-making, like frenzied selling amid a market slump or chasing after short-term gains driven by fear of missing out. These impulsive actions often result in poor investment outcomes.

Hedging strategies act as a stabilizing force in the face of emotional turbulence. Knowing that you have protective measures in place can provide a sense of security and peace of mind, which in turn can help you make more rational, disciplined, and well-thought-out investment decisions.

Instead of succumbing to emotional reactions, investors with a well-executed hedging strategy can maintain a long-term perspective, recognizing that market volatility is part of the investment landscape and that their portfolio is equipped to weather the storm.

By reducing emotional stress and promoting disciplined decision-making, hedging contributes not only to financial success but also to the overall well-being of investors. It allows them to stay focused on their investment objectives rather than being swayed by the emotional rollercoaster of the market.

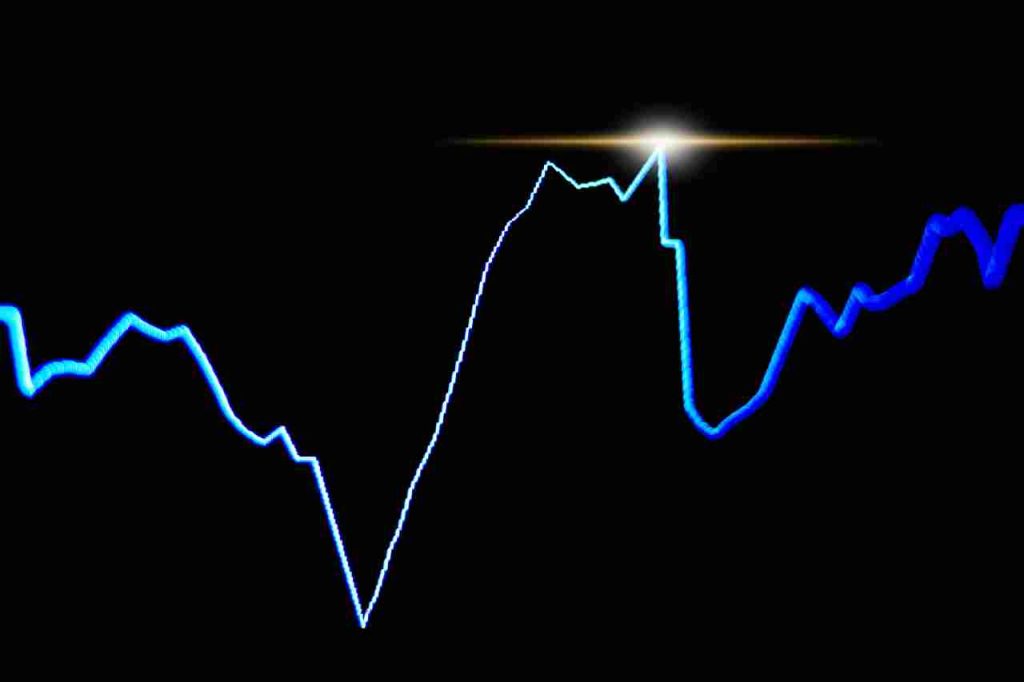

Steady Growth

Hedging plays a pivotal role in helping investors achieve steady and consistent portfolio growth, even in the face of turbulent market conditions. In traditional investing, the value of a portfolio can experience significant fluctuations due to the inherent volatility of financial markets. These fluctuations can lead to periods of rapid growth followed by steep declines, making it challenging for investors to predict and manage their returns effectively.

However, when hedging strategies are integrated into an investment approach, they act as a stabilizing force. This means that even during market turbulence or downturns, the impact on the portfolio is mitigated. For instance, if you hold a diversified portfolio of stocks and decide to hedge a portion of it using options or other instruments, the hedging position can offset losses incurred in the stock holdings during market declines. This results in a more consistent rate of growth because the losses are dampened, and the portfolio doesn’t experience the same level of volatility as an unhedged one.

In essence, hedging provides a smoother investment journey by minimizing the impact of market fluctuations. This steadiness in portfolio growth can be especially advantageous for investors with long-term financial goals, as it allows them to maintain a predictable and sustainable trajectory toward their objectives, regardless of the market’s ups and downs.

It also enables investors to stay committed to their investment strategy, as the reduced volatility and more predictable outcomes contribute to greater confidence in their financial plans.

Protection Against Black Swan Events

Protection against Black Swan events is one of the most compelling reasons to incorporate hedging strategies into your investment approach. These unforeseen and very disruptive events, often referred to as “Black Swans,” are distinguished by their extraordinary rarity and wide-ranging effects.

Examples include the sudden collapse of financial institutions, geopolitical crises, or global pandemics like the COVID-19 outbreak. When such events occur, they can trigger sharp and prolonged market declines, causing significant damage to investment portfolios.

Hedging serves as a financial safeguard in the face of these Black Swan events. By utilizing various hedging tools such as put options, inverse exchange-traded funds (ETFs), or short positions, investors can create positions that profit when markets plummet. While these hedges may result in costs during ordinary market conditions, they can prove invaluable during Black Swan events.

These protective measures can help offset the losses incurred in the rest of the portfolio, thereby preserving capital and preventing catastrophic declines in overall wealth. In essence, hedging acts as a form of insurance against the most extreme and unforeseeable market disruptions, offering investors a crucial layer of defense to weather the storm when Black Swans emerge.

Enhanced Asset Allocation

Enhanced asset allocation is a significant advantage of incorporating hedging techniques into your investment strategy. To establish a balance between risk and return, asset allocation entails distributing your investments among a variety of asset types, including stocks, bonds, real estate, and more. It’s a fundamental investment premise, and by employing hedging, you may more precisely adjust this allocation to fit your financial goals and risk tolerance.

Hedging allows you to allocate a higher percentage of your portfolio to potentially higher-risk, higher-reward assets while still having protection in place. Imagine, for instance, that you have an optimistic outlook on the stock market and wish to devote a sizeable amount of your portfolio to stocks. However, you’re aware of the market’s inherent volatility and want to mitigate the risk of a sharp downturn.

In this scenario, you can use hedging strategies, such as buying put options or employing inverse ETFs, to protect your equity positions during market declines. This protection allows you to be more aggressive with your equity allocation, potentially enhancing your returns when the market performs well while simultaneously reducing the risk associated with that allocation.

By using hedging techniques to fine-tune your asset allocation, you can strike a balance that aligns with your investment goals and risk tolerance. It empowers you to pursue higher returns from riskier assets while managing and mitigating the associated risks. This flexibility in asset allocation, combined with the risk management capabilities of hedging, provides investors with a powerful tool to optimize their portfolios according to their unique financial circumstances and market outlook.

Portfolio Flexibility

Portfolio flexibility is a crucial benefit of incorporating hedging strategies into your investment approach. Financial markets are dynamic and constantly influenced by various factors, including economic data releases, geopolitical events, and shifts in investor sentiment. In such a dynamic environment, having the ability to adapt and make informed decisions in response to changing market conditions is essential for successful portfolio management.

Hedging enables investors to maintain a nimble and responsive approach to their portfolios. Unlike rigid buy-and-hold strategies, hedging allows for the dynamic adjustment of positions as market conditions evolve. For instance, if you hold a diversified portfolio of stocks and you observe signs of increased market volatility or economic uncertainty, you can implement or adjust hedging positions, such as buying put options or reducing your equity exposure temporarily.

These hedging moves provide a safeguard while allowing you to react to new information or market developments without the need for a complete restructuring of your portfolio.

This flexibility is particularly valuable because it allows you to stay proactive in managing risk and optimizing returns in response to changing circumstances. It empowers you to make tactical adjustments that align with your investment goals, whether it involves capital preservation during turbulent times or seizing opportunities in bullish market conditions.

In essence, hedging provides the agility needed to navigate the complexities of the financial markets while maintaining a balanced and resilient portfolio.

Common hedging strategies that play a significant role in portfolio protection and risk management

Diversification

Diversification is a foundational concept in investing that serves as a straightforward yet highly effective form of hedging. Spreading your investments over a variety of various asset classes, sectors, or geographical areas is the essence of diversification.

By doing so, you’re effectively reducing the risk associated with a single investment or asset class. The idea is that if one part of your portfolio experiences a downturn, other components may perform differently, potentially offsetting those losses.

For example, suppose you have a portfolio heavily concentrated in technology stocks, and a sudden industry-wide downturn hits the tech sector. Without diversification, your portfolio would be at the mercy of this single sector’s performance.

However, by diversifying across various asset classes, like adding bonds or real estate to your portfolio, you’re less exposed to the risks associated with any single sector’s downturn. This spreading of risk helps protect your overall portfolio, making it more resistant to changes in the market and ultimately reducing the impact of a downturn in any one sector on your overall investment performance.

Diversification is a simple yet powerful way to enhance your portfolio’s risk-return profile and is a cornerstone of prudent risk management in investing.

Put Options

You can sell a stock at a fixed price (the strike price) before the expiration date by purchasing put options. This strategy can protect your portfolio from significant declines in the underlying asset’s value.

Stop-Loss Orders

Setting stop-loss orders on your investments can limit potential losses by automatically selling a security when it reaches a predetermined price. This prevents you from holding onto a declining asset in the hopes of a rebound.

Short Selling

While short selling is a more advanced strategy, it involves selling borrowed shares with the expectation that their price will fall. This can help offset losses in your long positions.

Hedge Funds and Mutual Funds

Some funds are specifically designed to hedge against market volatility. They employ various strategies to protect their investors’ capital during turbulent times.

Conclusion

In uncertain and volatile markets, protecting your portfolio should be a top priority. Hedging strategies offer valuable tools to help you manage risk and minimize potential losses.

By diversifying your investments, using options, setting stop-loss orders, or considering hedge funds, you can tailor your approach to match your risk tolerance and financial goals.

Remember that no strategy is foolproof, and there are costs associated with implementing hedging techniques. Before adding hedging to your portfolio, it’s critical to perform in-depth research, maybe speak with a financial professional, and give serious thought to your investing goals.

With the correct strategy, you may control your risk more effectively overall when investing while navigating the ups and downs of the financial markets with more assurance and resilience.