Table of Contents

Gold investment is one of the oldest ways to invest capital and accumulate savings. Not surprisingly, after all, gold has long been a symbol of wealth. Things have changed a bit over the years, and gold investments are not always based on buying bullion in physical form. How to invest in gold?

Gold investments – what does it consist in?

It is worth knowing that investment gold comes not only in physical form, but also in paper form. And before investing, it is worth deciding in which type of gold to invest your money. In case gold for an investor is to provide a safe haven and protect his savings from situations such as hyperinflation, physical investment gold will be a good choice. Investing in gold is an investment for the future, not speculation.

How much can you earn from gold investment?

In particular, it is worth remembering that, as with any other investment commodity, gold is also characterized by quite high volatility. An investor can hit a long period of price declines, and if he took a short time horizon, unfortunately, he can lose on gold. However, if he plans to hold bullion for a long time, then making money on gold makes sense.

Types of investment gold

There are two main types of gold – physical and paper gold. Which one an investor chooses depends on his individual preferences, method of investment, time horizon, etc.

What is physical gold?

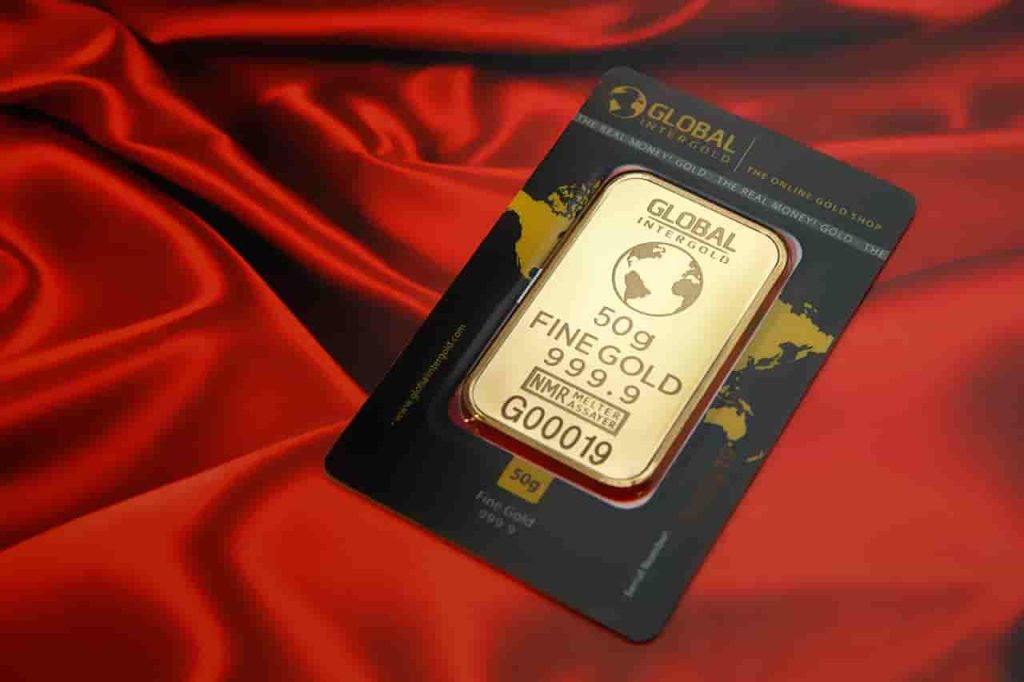

In this case, we are talking about a real metal that can be taken in hand. It is available in the form of gold bars or coins. Such products contain almost exclusively the bullion itself. In addition to this, they do not show collector value or any aesthetic qualities. Their price depends primarily on the gold content and the current market rate. All this makes physical gold excellent for investment purposes.

Investing in gold coins as well as gold bars has almost the same benefits, so it doesn’t really matter which one an investor chooses. However, be sure to invest in products from reputable manufacturers that are highly regarded among investors. In addition, gold coins should be in good condition, bars, on the other hand, additionally in protective certipacks that confirm their authenticity.

It is best to invest in bars from mints such as Heraeus, Valcambi, Umicore or the Polish Mint. When it comes to bullion coins, it’s best to choose American Eagle, South African Kruggerand, Maple Leaf or Australian Kangaroo. This way, when the investor wants to sell his gold, any of the above products will easily sell at a good price.

When deciding to invest in gold, it is worth bearing in mind that individual coins and bars differ from each other only in appearance, but also in weight standards. You have to pay several hundred USD for the cheapest one-kilogram bar, as well as for the cheapest 1/25 ounce coin.

There are also numismatic and other collector’s specimens. In the case of jewelry, collector coins, as well as various other types of gold artifacts, such as horseshoes or figurines, the actual weight of the bullion is not so important. Much higher is the collector value, which can significantly exceed the real value of the metal.

Gold investment – what is paper gold?

Paper gold is all financial instruments that give the investing person exposure to the price of gold. For the most part, such gold will not even be seen by the investor, but he or she will be able to make money if the value of the gold rises, or lose, if the price falls. The entire transaction will be settled in fiat money, with no supplier of physical bullion.

Paper gold specifically includes ETF fund units. Most of them function in such a way that with the funds obtained from investors, they buy and store actually existing gold bars. For this reason, the valuation of ETF units, usually accurately reflects the quotations of bullion on the financial markets.

However, the vast majority of ETFs do not allow investors to convert units into gold bars. There are, however, a few entities that offer this option, but only for large denominations. There are also ETFs that use synthetic replication and do not hold gold at all.

Investment in paper gold is done in the same way as in stocks, for example, since they are listed on the stock market. To buy them, one must have an investment account with access to a specific exchange. In addition to ETFs, the investor has a wide range of units of traditional mutual funds or investment certificates (read more: Investing in ETFs). However, it is worth knowing that it is ETFs that offer lower management fees. On the other hand, investing in foreign markets through brokerage offices, usually involves a relatively high buying and selling commission.

There are also gold futures contacts, which are the domain of the New York Commodity Exchange. In this case, one contract is equivalent to 100 ounces of gold. These types of contracts allow you to bet with other market participants on which direction the price of gold will go. Such a solution allows you to make money on gold also during a period of decline. In the case of ETFs, such a possibility does not exist.

Investment in physical gold or paper gold? Which to choose?

The key advantage with physical gold is that it allows you to enjoy all the properties of physical bullion. Gold is characterized by high durability, can be easily transported and can be easily monetized in any part of the world. Moreover, the bars or coins are stored by the investor, so to speak, outside the system – he can keep them where he wants and does not have to worry about the actions of financial institutions or the government.

However, it is worth remembering one thing that gold investment entails. In many countries you can anonymously purchase gold up to the value of 15 thousand euros. Investment gold also has a very important advantage, which is related to the issue of taxes. According to regulations and interpretations of tax offices, it can be considered not as a form of investment, but a tax-free way of storing assets. However, in order to truly avoid paying tax, the sale of a gold coin or bar must take place at the earliest six months after its purchase.

However, investment in physical gold also has several downsides:

- The need to store bullion, which usually generates additional fees,

- The problematic nature of the purchase transaction itself, i.e. identifying the best offer and assessing the authenticity of the gold, as well as its subsequent resale – putting up an offer and finding a buyer,

- It really pays to buy only gold of relatively high weight – at least 1 ounce.

Is it better to bet on paper gold?

When it comes to investing in paper gold, to the advantages and disadvantages look a little different, not from the case of physical gold. The advantages of instruments that are based on gold include the ease of transactions and the absence of problems, as well as storage costs. There are, however, transaction fees, and possibly – for maintaining an investment account.

With the help of paper gold, investors can use a variety of investment strategies, as well as react freely to the situation that changes in the market. In addition, investments in paper gold make it possible to conveniently enter the market with a small capital on the same terms that wealthy investors can count on. In this case, there are no producer margins that would affect the profitability of low-value investments.

The key disadvantage of paper gold is that it does not allow you to benefit from the properties of physical bullion, which in turn entails another disadvantage, namely the lack of complete anonymity and control over the investment. There is also the risk of the broker, the exchange and the banking system. In addition, an organizational and technical infrastructure is necessary for the market to operate. This type of gold can be traded by the investor only under established rules, with the help of an investment platform. Moreover, it is treated in the same way as any other stock market investment, so it is associated with the need to pay capital gains tax (read also: How to invest in the stock market and How to start investing in the stock market).

Where and how to store gold?

When deciding to buy physical skin, it is worth considering its safe storage, as it is vulnerable to theft. Here are some places to put gold bars and coins.

A safe for gold at home

The investor should choose a safe depending on the value of the things he intends to store in it. This solution will not make sense if the physical savings do not have a very high value. They simply will not be worth installing the cheapest certified safe. A safe will work well for higher savings, above USD 10,000.

Bank safe deposit box

Investment gold in physical form can also be stored in a bank. Unfortunately, this is a scarce service and it is not easy to find a free bank cache. Alternatively, there may be private companies that rent caches, but in this case the cost of storage will be higher.

Safe deposit box at a dealer

When buying investment gold from a dealer or manufacturer, the investor is likely to receive an offer to store the bullion bought. Such offers are often attractive in terms of price and will depend on the entity and the weight of the gold.

How is the gold insured?

Gold that is stored at home can, of course, be insured. However, there is no insurance that is dedicated to owners of valuable bullion on the market. The insurance company will reimburse the injured party in case of theft or destruction of everything that was on the insured property. However, this is part of the loss – not all of it. These amounts are in the order of tens of thousands of USD, which is far too little, even in the case of storing only a few ounces of investment gold. In addition, many insurances exclude gold bars in their general conditions. However, if an investor decides to keep gold in a home safe, he can simply insure the entire safe for a given amount.

How to choose a gold dealer?

To buy gold, it is best to go to a professional precious metals dealer, especially in a situation where the investor is just starting to invest in gold. What should a good dealer be characterized by?

- Have a stationary point where employees will be able to advise and help in choosing the right product,

- Have been operating in the market for a long time or be part of a large group of companies,

- Will allow you to buy the coins and bars of your choice on the spot. You don’t have to pay for the goods in the first place and wait for delivery.

Buying gold – fair conditions

Investment in gold should be based on a fair approach of the dealer. This, in particular, consists in fast delivery after payment, as well as convenient payment terms. It is worth appreciating the possibility to buy gold also for cash, which guarantees anonymity.

Is gold investment safe?

Investment in gold is one of the safer forms of investing money. This is due to the fact that in times of crisis there is no risk:

- a large increase in supply, as in the case of fiat currencies,

- bankruptcy, as in the case of listed companies,

- associated with changes in ownership or taxation.

However, it is important to keep in mind that simply owning physical gold, does not bring current income, such as interest rates.

Advantages of gold investment

Gold investment has many positive aspects. It allows you to secure and multiply your wealth, although you should not forget about the risks involved.

Limited supply of gold in the market

Gold has always been a very valuable and desirable metal. For this reason, from time immemorial, gold has been a bullion that has been sought after, mined and processed into jewelry and coins, among other things. According to various estimates throughout the world’s history, some 160,000-190,000 tons of gold have been discovered and mined. In addition, about 3,000 tons of bullion are discovered each year around the world, and about 1,200 tons are recovered from recycling.

However, it should be remembered that a certain portion of gold is lost, due to various armed conflicts and disasters in the world. In turn, a large part of the bullion that is used in industry is not recycled, as it is not cost-effective to do so in some technologies. This results in an ever-increasing demand for gold bullion, with the world’s population continuing to grow. This in turn causes the price of bullion to keep rising and will continue to do so.

Safe haven

Investment gold has long been characterized as highly resilient to global crises. On inflation, unstable economies and armed conflicts, gold only benefits. For years it has been regarded as a safe haven to which investors turn when the market gets risky. This is due to the fact that gold can’t be added to like money, and is unable to go bankrupt like a company during a crash. Investments in gold are considered a hedge against a decline in the value of money.

Flexibility of investment

Gold investment does not require the execution of purchase frequency and timing imposed by other people or institutions. Investment gold can be purchased in any form, at any time and in any weight.

Moreover, buying gold does not have to be a huge expense at all. There are bars available on the market that weigh as little as 1 gram and cost several hundred USD.

What’s more, investment gold can be sold at any time when the investor finds the price attractive or when the life situation forces him to do so.

High liquidity when selling

As in any other investment, when deciding to start an investment, an investor needs to think about how and when he or she will complete it. Sometimes it is not easy to find a buyer for a stock that is plummeting in value or a property that has lost its original value over time. When it comes to investing in gold or other precious metals, this problem is basically non-existent. Regardless of the market and economic situation, there will be someone willing to buy gold. There are many places, as well as ways to sell gold, starting with bullion dealers, through financial institutions and banks, currency exchange offices, jewelers and individual investors.

Diversify your investment portfolio

The strategy of putting all your savings into one asset is wrong. No matter what the asset is – stocks, bonds, cryptocurrencies, currencies, artwork or real estate (read more: How to invest in currencies online or Investing in stocks and bonds). If an investor has taken the strategy that he invests either directly in stocks or through mutual funds, he should secure his investment portfolio by investing in another safe asset, such as investment gold.

In a long-term strategy, the price of this metal is much more stable than that of stocks (read more: How to invest in stocks). In addition, it does not require a one-time large investment, as is the case with, for example, real estate. It also does not require the investor to have specialized knowledge, including experience in the market, such as art – when deciding to buy sculptures or paintings. Ideally, investment gold should account for about 10% of the value of an investor’s investment portfolio in stable times. On the other hand, in unstable periods and during a crisis, it is worth investing in precious metals even 40-50% of the value of the investment portfolio.

No risk of bankruptcy

Investment gold, unlike other investments, such as stocks, is 100% immune to the risk of bankruptcy. Unfortunately, even the largest listed companies or banks, can go bankrupt. When it comes to gold investments, there is no such risk. Investment gold rewards long-term investors in the form of satisfactory rates of return.

Tax benefits

Investment in physical gold comes with many tax benefits. Buying investment gold, is exempt from VAT, after meeting the following conditions:

- When purchasing bars with a minimum purity of 995,

- When buying coins that have a minimum purity of 900; were minted after 1800 and are or were means of payment in the country of minting, and their price does not exceed 80% of the market value of the gold contained in the coin.

However, the most important benefit for individual investors, involves the taxation of profits on the sale of gold. When selling investment gold, an investor does not have to pay income and capital gains taxes if he decides to sell it after 6 months of buying it.

Convenience of buying

Not so long ago, to buy investment gold, one had to go in person to a branch of the national bank. Currently, you can invest without leaving home, as is the case with investing in bonds, stocks, etc. Everything can be arranged online. The idea is to invest in paper gold, which is convenient and basically does not require getting up from the armchair.

Investing in the stock market – what is worth remembering?

First of all, it is worth knowing that investing in the stock market involves the risk of losing some or all of your capital. However, there are effective ways to minimize them. While you can’t eliminate the risk completely, you can reduce it by applying the following principles.

Learning

To be a successful investor, you should never stop learning. Continuous expansion of knowledge is the basis for generating profits rather than losses. It is advisable to get knowledge from various sources, such as books, articles, magazines, but also ebooks. For those who want to know investing professionally, training and courses on investing, which can be easily done online, will be invaluable.

Investing according to your knowledge

Every investor should invest money only in those financial instruments on which he is familiar and about which he has at least basic knowledge. It is better not to invest at random – of course, with a bit of luck, an investor can gain, but in the long run such action will not pass the test. For example, when deciding to invest in gold, it is advisable to learn as much as possible about it beforehand.

Acceptance of risk

Investment risk is unfortunately inherent in investments. You always have to reckon with the fact that you can lose funds. There is no need to luxuriate in the clouds, as one can fall painfully to the ground. An investor should accept that risks exist and come to terms with it.

Putting emotions aside

This is a very helpful skill when it comes to investing. A successful investor is guided only by cool calculation. Unfortunately, making decisions while acting under the influence of emotions usually leads to a loss. While it’s very hard not to get stressed or excited, especially when prices are rising, it’s always a good idea to approach investments in cold blood.

Read also: Contracts for differences

Choosing the right investment platform

This issue concerns investing in paper gold. An investor can do this with the help of an investment platform provided by a broker. When deciding on a particular choice, several important factors should be taken into account. The trading platform should work quickly and reliably. Even the slightest delay, unfortunately, can result in the generation of a loss. In addition, it should have a friendly and intuitive interface, which is important especially for beginners (read more: Online trading). The cost of making transactions is also not without significance – the price list is always worth checking before making a choice. Before that, it is best to try out the platform by investing on a demo account, where no real money is at risk.

Read also: Online stock market simulator

Gold investment is considered one of the safest investments. It will work great especially for investors who focus on long-term investing. There is a choice of either physical or paper gold, so everyone can choose according to their preferences. However, it is always a good idea to keep investment risks in mind and try to reduce them by learning and applying effective tips.